Beyond The Bottle: The Decline of Alcohol + the Rise of New Rituals

Case Study

Published May 2025

Insights from Langston’s Health and Wellness Study, May 2025.

Overview

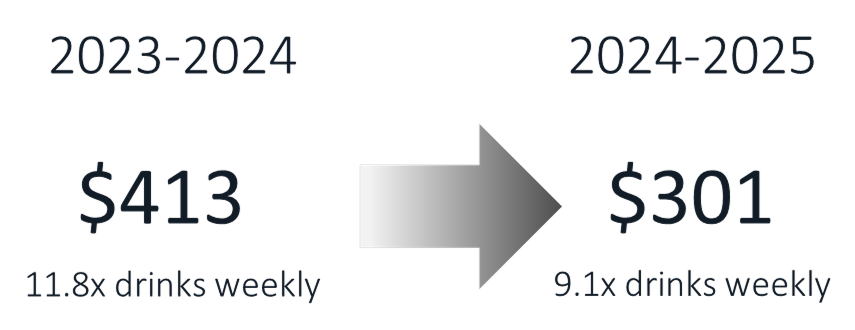

Langston’s 2025 Health & Wellness Study reveals a cultural shift in motion: Americans are not quitting alcohol en masse, but they are drinking less, more intentionally, and with growing awareness of how it fits (or doesn’t) in their lives. Over the past two years, average weekly alcohol consumption has dropped by nearly three servings, and consumer spend has decreased by 27%, yet only 2.5% of people have given it up entirely.

This points to a new drinking culture that is rooted in moderation, wellness alignment, and personal choice.

For You

There’s less pressure to drink-and more ways than ever to unwind, connect, or celebrate without alcohol.

For Society

This shift signals a growing cultural emphasis on wellness, with promising implications for mental and physical health.

For Brands

As alcohol becomes optional in key rituals, brands must evolve-offering non-alcoholic, functional, or wellness-aligned options to stay culturally relevant.

Insights

Insight 1: Cutting Back, But Not Cutting Out

One of the most telling findings from the study is just how widespread this shift in drinking behaviors really is. Among U.S. adults ages 23 to 74, nearly one in three (31%) say they’re drinking less than they were two years ago. That’s equivalent to 69 million Americans. But among them, just 5.3 million, or 2.5%, have gone from drinking weekly to not drinking at all. This means that while very few are adopting a sober identity, many are choosing a lower-alcohol one.

Changes to Spend & Consumption (US Population Aged 23-74)

This moderation mindset is gaining traction across segments and demographics, and in particular by younger or more trend-forward and experientially-driven adults. Ultimately, Americans aren’t rejecting alcohol, they’re revising their relationship with it.

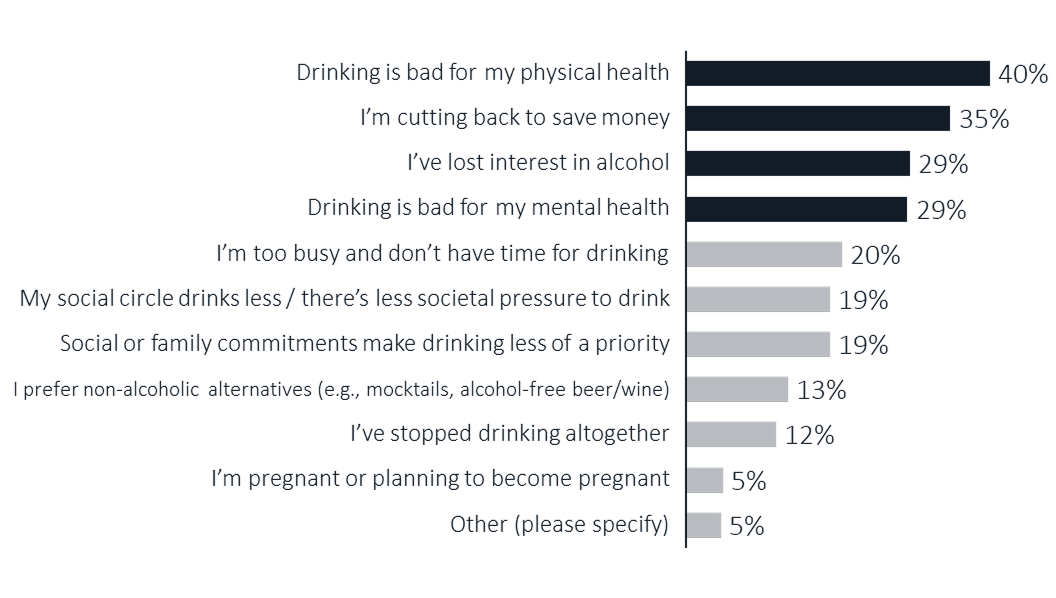

Insight 2: Health and Lifestyle Are Leading the Shift

Why are Americans drinking less? Health is the driving force. At a high level, the top motivators for a reduction in drinking include:

Physical health concerns (40%)

A desire to save money (35%)

A loss of interest in alcohol itself (29%)

Mental health concerns (29%)

Reasons for Drinking Less (US Population)

In a nutshell, people are drinking less because alcohol increasingly feels like it no longer serves them, whether that be physically, emotionally, financially, or socially.

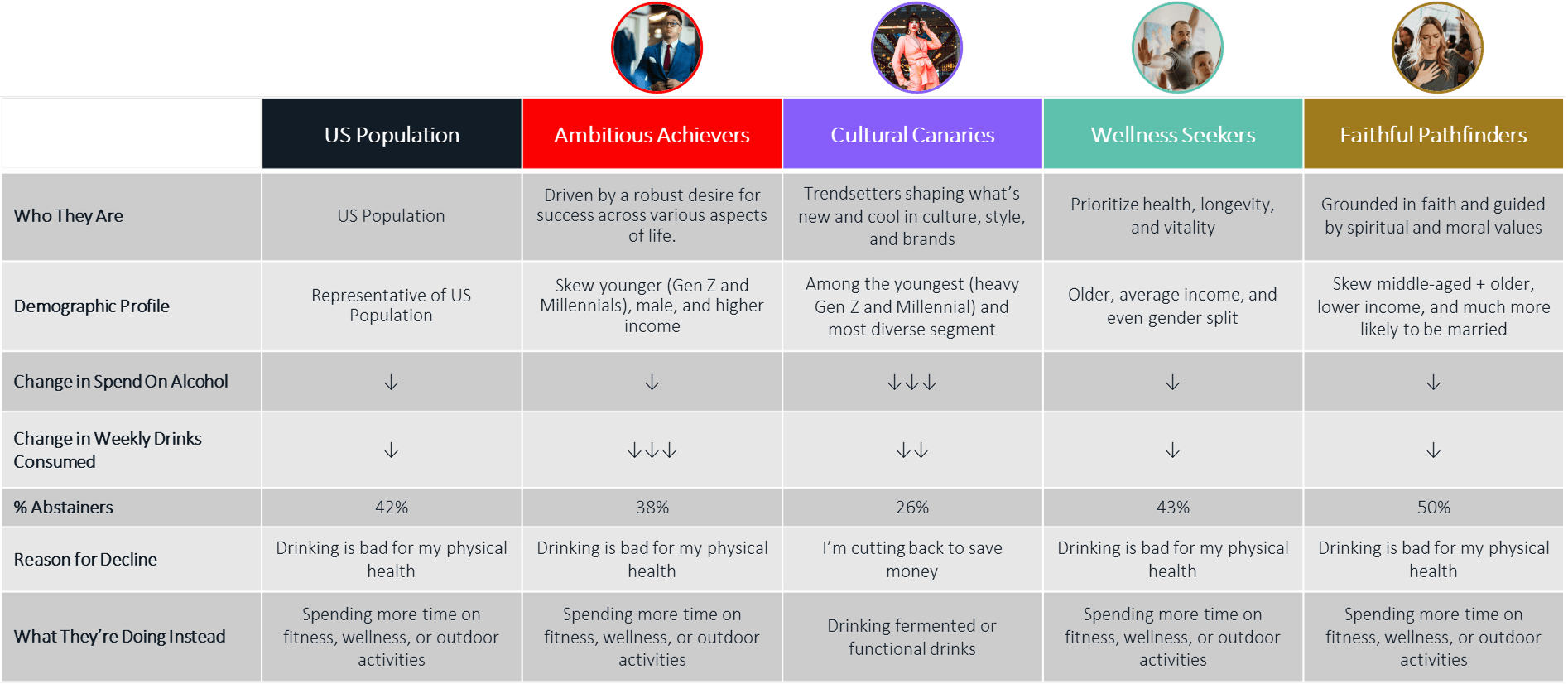

The Life Lenses segmentation adds even more clarity to the forces that are driving this behavioral shift:

Faithful Pathfinders and Wellness Seekers are the most likely to cite health as a motivator.

Ambitious Achievers cite lack of time and high levels of responsibility—they may see themselves as being “too busy to drink” because of a need to stay mentally sharp and use precious minutes of each day for accomplishing goals.

Cultural Canaries, who are trend-sensitive and future-facing, are losing interest in alcohol altogether and exploring replacement products.

Distinctive Reasons by Life Lenses

Notice that it’s the older, less professionally-oriented segments who are more likely to cite health concerns—both mental and physical—as reasons for drinking less.

Among Americans who are drinking less, 46% say they’re not replacing alcohol with anything at all — they’re simply skipping it.

However, there is also a large portion of consumers who are drinking less that are replacing alcohol with something more intentional: more than 40% say they pursue healthier habits and behaviors in place of drinking, whether that’s a workout, a good night’s sleep, or just staying home. Others have turned to moderation, whether by drinking socially but less frequently, drinking more mindfully, or skipping high-alcohol drinks in favor of alternatives with less booze.

Insight 3: What’s Replacing Alcohol? New Rituals, Familiar Goals, or Nothing at All

Top Alternatives to Drinking

Cannabis, THC, and even psychedelics are emerging as key alternatives to drinking, especially among trendsetting groups like the Cultural Canaries. This digitally immersed, culturally influential segment is redefining what it means to unwind and are more than twice as likely to say they replace alcohol with fermented or functional drinks (31%), mocktails (24%), or psychedelics like mushrooms or LSD (22%).

As early adopters and “cultural bellwethers”, the shift in behaviors among the Cultural Canaries signals what could be coming next for the broader US population — creating momentum for alternative beverages and “mind-expanding experiences” to move from niche to norm.

Insight 4: The Shift Looks Different Depending on Who You Are

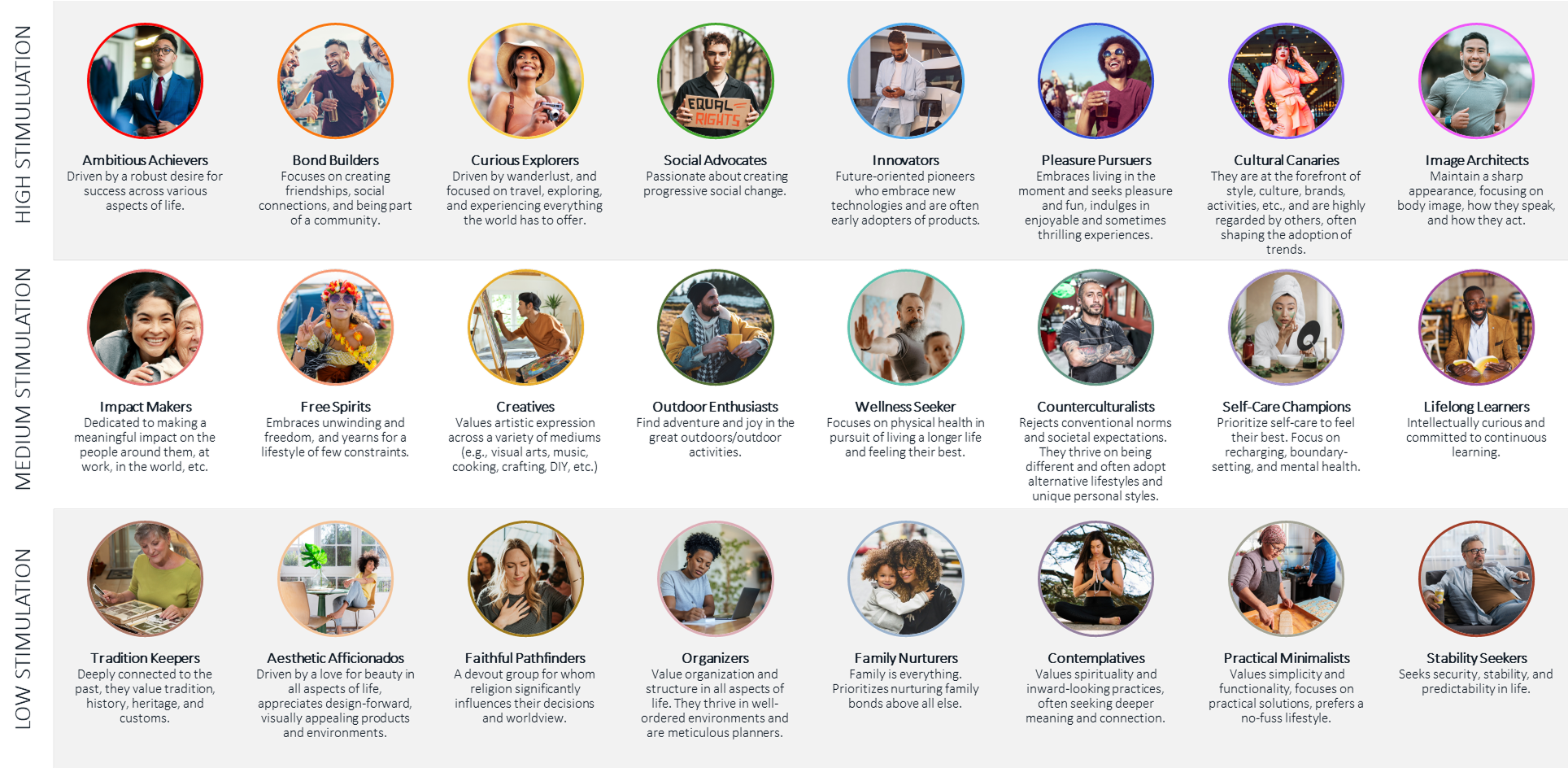

Langston’s Life Lenses framework adds critical nuance to this story. By organizing consumers into 24 behavioral and values-based segments, we can see how different types of Americans are experiencing this shift:

Ambitious Achievers' choice to drink less is more so about maintaining high-functioning routines and minimizing friction rather than rejecting alcohol ideologically.

Wellness Seekers are more likely than average to cite physical health as a reason for cutting back. Their replacements are health-anchored, like drinking water, exercising, or prioritizing rest.

Faithful Pathfinders’ reduction in consumption is measured and health-conscious, but not defined by trend adoption or novelty-seeking. They are quietly opting out of alcohol, without needing to opt in to anything else.

Cultural Canaries are trend-sensitive early adopters moving toward emerging alternatives.

Insight 5: The Opportunity is Bigger Than Beverage

This shift in how Americans are consuming and engaging with alcohol doesn’t just reflect a trend in drinking, but also serves as a signal in how Americans take care of themselves. The culture of consumption is being rewritten, and alcohol is no longer the automatic centerpiece of reward, relaxation, or connection.

What replaces it? That depends on who you’re talking to. That’s where Life Lenses becomes an essential tool for brand strategy. It helps companies understand what’s motivating different consumers, what emotional needs alcohol — as well as other health & wellness behaviors — are used to fulfill, and the products, services, or experiences that may be in prime positions to take its place.

About the Study

Langston’s 2025 Health & Wellness study surveyed over 3,000 U.S. consumers ages 13 to 79, and balanced the sample across gender, age, region, and income to ensure a representative snapshot of the American population. The study covered health behaviors, wellness priorities, and consumption across categories, including alcohol, fitness, nutrition, fertility, and more.

At the heart of the analysis is Life Lenses, Langston’s proprietary segmentation framework. With 24 distinct psychographic segments, Life Lenses helps brands and marketers understand not just what people do, but why they do it to help enable smarter, more resonant strategy.

You can learn more about the Life Lenses segmentation and download our free Meet the Segments report with detailed insights about each of the 24 types of consumers here. The report includes information about how each segment is defined, what percentage of shoppers fall into each segment, and insights on how brands can reach and activate them.

24 Life Lenses shape how we navigate the world. They are:

Let’s Talk

This report focuses on a singular topic and only contains a fraction of the rich information found in the overarching Health & Wellness study it is part of! Reach out to the Langston Team for more actionable insights about the Health & Wellness space uncovered in this deep dive study with 3,000 consumers. We look forward to sharing more!

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.

More insights, more data. Download this study to learn more.

In order to conduct unbiased and objective research, this study was privately funded by The Langston Co. We did not receive endorsement or financial support of any kind from any third party.

Thanks for taking time to read our research. With questions, comments, or suggestions about this study, please contact us at contact@thelangstonco.com.