Category Research in Days: Langston Landscapes Explained

Blog Post

Our Landscapes ecosystem delivers custom-fit strategy and storytelling—without the time or cost of starting from scratch. It gives brands access to rigorous, category-level data and an expert partner to turn insights into decisions.

Apparel Basics is one of our flagship Landscapes categories. Below we’ll see why it’s a great case study for how Landscapes provides the breadth and depth needed to find growth in a category.

But first, an introduction to the Landscapes ecosystem itself.

What is Landscapes by Langston?

Landscapes is Langston’s on-demand research ecosystem. We continuously field rich, representative studies across priority categories. Each study includes full brand funnels, brand associations, shopping triggers, discovery paths, retailer mix, category needs, shoppers’ willingness to pay, a built in needs-based segmentation called Life Lenses, and so much more.

When you leverage Landscapes, you get two things at once:

Fast access to a high-quality dataset

A strategy partner who helps you translate findings into actionable insights

Why Brands Choose Landscapes

There are several reasons for choosing a Landscapes study over traditional research:

Speed and Rigor: No need to wait for a custom brief, design a survey instrument from scratch, or wait for fieldwork. We’ve already fielded, cleaned, and tested the data in your category so it’s ready for analysis on day one.

Breadth and Depth: We cover a wide array of brands and retailers in your category to give you the big competitive picture. We also measure the full shopper journey to help you get closer to the consumer all the way to the point of purchase. What’s more, we tap into the emotional and functional jobs the category must solve for shoppers, giving you the personal and human context shoppers bring to your category to help you optimize messaging and positioning.

Action Orientation: Deliverables are built to answer real, useful questions for insights professionals. From retail sell-in stories to pricing ladders to segment activation plans, Langston’s insights are more than interesting - they’re actionable.

Landscapes in Action: The Apparel Basics Category

Now that we’ve seen all that Landscapes has to offer (and hopefully got your wheels turning for how it can help you!), let’s see it in action in the Apparel Basics category.

The Apparel Basics landscape spans underwear, socks, and base layers, with additional read across to outerwear, insulated jackets, and fleece jackets as well. Our full Apparel Basics dataset includes tens of thousands of consumer responses about the entire category, providing the breadth needed to understand the category and the ability to dive deeper into a specific brand, retailer, or consumer segment.

Consumer Insights from Landscapes

Our Landscapes ecosystem is powered by our modular research approach, modOS. These modules deliver structured insights based on time-tested research methodologies.

1) Category health and brand funnel

See awareness, familiarity, consideration, and conversion across the competitive set. Identify where conversion drops and where attrition signals appear when comparing results such as consideration to purchase behavior. This is where you spot everything from one-and-done buyers, pent up demand, and latent conversion.

Example questions we answer:

Is the category leader converting at every stage or leaking after consideration?

Which challengers have high awareness but weak familiarity?

Which brands show a warning sign where many buyers do not plan to buy again?

What we found in Apparel Basics:

Hanes, Calvin Klein, Fruit of the Loom, and Victoria’s Secret are ubiquitous underwear brands, with nearly universal awareness.

Digital-first brands tend to lag behind in familiarity conversion, an indication that the “I’ve heard of it” phenomenon is quite common.

Hanes remains highly considered and relevant, with strong past year purchase conversion. In short, Hanes has a right to win across consumer groups.

2) Competitive storylines from associations

Brand associations reveal the mental shortcuts shoppers use to identify what brands stand for and align with.. Some brands “own” particular associations, but fall short in others. Larger brands might be associated with many things, indicating a potentially unclear brand identity. We show where each brand over indexes and how that maps to your strategy.

How this gets used:

Positioning refresh

Messaging hierarchy for packaging and PDP copy

Creative briefs that ladder features to emotional benefits

What we found in Apparel Basics:

Underwear brands have distinct brand identities, with Hanes and Fruit of the Loom standing out for being comfortable, durable and a good value, while Victoria’s Secret is sexy and stylish.

Calvin Klein owns a brand identity of high quality, stylish, trendy, sexy, and luxurious

Hanes is seen as comfortable, durable, a brand I trust / for me, and a good value.

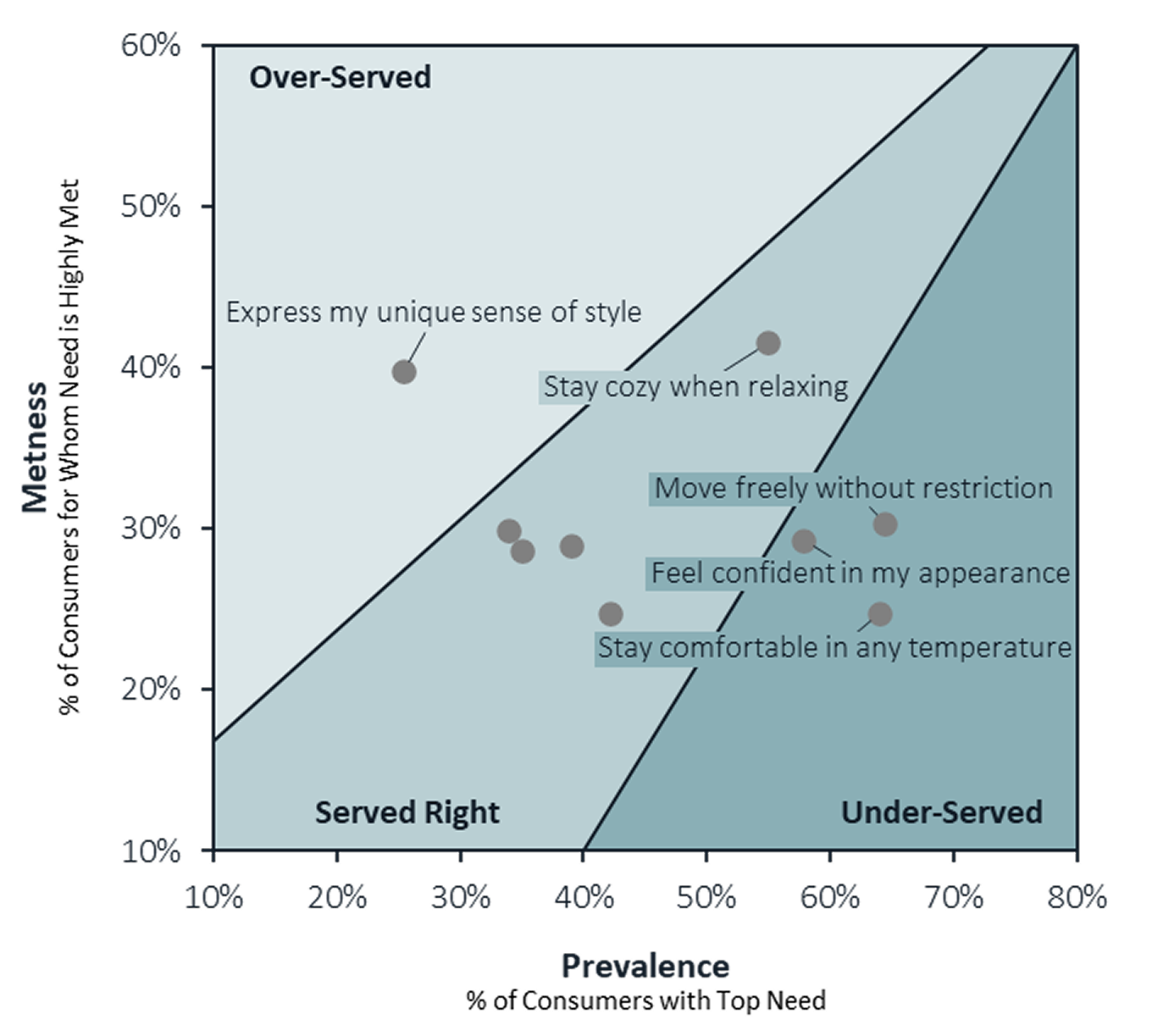

3) Unmet needs that unlock growth

The needs map plots how prevalent a consumer need is in a category and how well it is served by existing brands today. By treating these needs as multidimensional, we can understand not just what needs people experience most often, but which are unmet, which they’re willing to pay for, and which they thing they’ll have in the future.

What this solves:

Innovation pipeline themes

Rationale for pricing above the value core

Improved messaging centered around unmet needs

What we found in Apparel Basics:

Highly common needs like “comfort in any temperature”, “confidence in appearance’, and “freedom of movement” are both common and not well met by brands today, signaling opportunity

Victoria’s Secret, Hanes, and Calvin Klein best serve “feel confident in my appearance”, which has the strongest correlation with brand advocacy scores in the category

Apparel Basics Consumer Needs Map

4) Journey moments that actually convert

Landscapes help you uncover shopping triggers, discovery, and preferences in your category. Learn what causes people to enter the category in the first place and what steps your brand can take to meet them in the right place at the right time by meeting the right needs.

Practical plays:

Endcap or seasonal features tied to replenishment and comfort in temperature

Fit confidence tools on PDPs to reduce size uncertainty

Micro video to show fabric behavior and breathability

What we found in Apparel Basics:

Apparel basics purchases often start as replenishment

Discovery happens most in store or on retailer websites, but more than half of shoppers prefer to buy in person. This is where distribution and in-store storytelling matter most.

In apparel, comfort is king. In fact, nearly 8 out of 10 underwear shoppers select “is it comfortable and soft” as a top consideration factor, with 1 in 4 selecting it as their first priority.

5) Willingness to pay and the right price ladder

By understanding people’s willingness to pay for certain sub-categories, we can understand not just the upper and lower limits of sub-category pricing, but also dive deep into what consumer segments are spending the most and deserve the most attention.

What you get:

A price architecture with clear reasons to believe at each step

Guardrails that protect value while introducing premium tiers

Messaging that ties price to testable benefits

What we found in Apparel Basics:

In the underwear category, shoppers cluster between willing to pay $10 and $24 per pair for underwear, while smaller high value segments will pay more for clear benefits such as “cooling”, “movement”, and “premium feel”, suggesting an incremental premium ladder rather than a single jump.

A look at the Hanes brand suggests a massive, untapped opportunity to charge more premium prices to engaged category shoppers.

6) Segment strategy with Life Lenses

Life Lenses is Langston’s proprietary universal needs-based segmentation that applies across all categories in Landscapes. Its 24 consumer segments provide a variety of perspectives on the category, and can help you target which segments are right for your brand. We even use these as key ingredients to create special category-specific segmentations within each category for added utility.

Activation Ideas:

Tap into underleveraged consumer segments with new messaging at the brand level

Align product-specific messaging with the needs of specific Life Lenses segments

Prioritize innovation for the highest spending Life Lenses segments in your category

What we found in Apparel Basics:

Major brands like Hanes are best suited to target Life Lenses segments at the product level

Cultural Canaries and Innovators are the two Life Lenses most willing to pay $25+ for a pair of underwear. In fact, both groups are 2x more likely to spend a premium compared to the average consumer in the space.

Image Architects seeking to feel confident in their appearance and Practical Minimalists wanting to stay cozy while relaxing.

Frequently Asked Questions about Landscapes Studies

-

It is a ready-to-use research ecosystem that provides category level data and an expert partner to turn that data into decisions. You get answers in days rather than months.

-

Landscapes leverages the results and data from rigorous studies that have already been fielded, so you move faster and spend less for high-quality data. You can still add custom modules or follow-on work if needed for added value.

-

The Life Lenses segmentation aligns product and marketing to the underlying jobs shoppers want solved. It shows valuable insights like who drives volume, who drives premium mix, and what messages each group needs to hear.

-

Immediate dataset access and a tailored readout within 1-2 weeks that you can use for a variety of cases, such as sell-in conversations, portfolio, pricing, and creative briefs.

How to Use These Apparel Basics Insights Today

Here’s how you can use the insights from this study:

Align leadership on a price architecture that protects value and creates a credible premium step

Prioritize innovation briefs around temperature comfort, movement, and fabric feel

Strengthen in store and PDP storytelling with short proofs that build fit and fabric confidence

Plan a small, style forward capsule to attract high spending segments without confusing the core

Want this exact analysis for your brand and top retail partners?

Get a Landscapes readout tailored to your questions. We bring the data, the story, and the sell in materials. Reach out to Langston to get started.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.

What the Deliverable Looks Like

With Landscapes, you get a traditional report deliverable you’d expect. But we also aim to maximize value by giving you access to the data and workshops specific to your needs.

A tailored readout built around your questions

Category level data with brand and retailer cuts where relevant

Clear next steps for retail sell in, portfolio, pricing, and creative

A follow up working session to translate findings into briefs and tests

Most teams use the readout to brief product teams, refresh PDPs, and align with sales on retailer conversations. The same deck often becomes the backbone of a seasonal go-to-market narrative as well, aligning with Landscapes’ annual cadence.