Understanding the Consumer Insights Role Through the Work It Requires

Blog Post

Consumer Insights roles are often described in terms of outputs: reports delivered, dashboards updated, questions answered. But anyone who has held the role knows those descriptions miss what actually defines the work.

The real work of Consumer Insights is shaped by questions: where they come from, how quickly they need to be answered, who is asking them, and what’s at stake when they are.

At Langston, years of close partnership with Consumer Insights leaders across industries revealed a consistent pattern. Regardless of company size or category, insights leaders find themselves operating across a small number of distinct modes of work. Each mode carries its own pressures, expectations, and opportunities for impact.

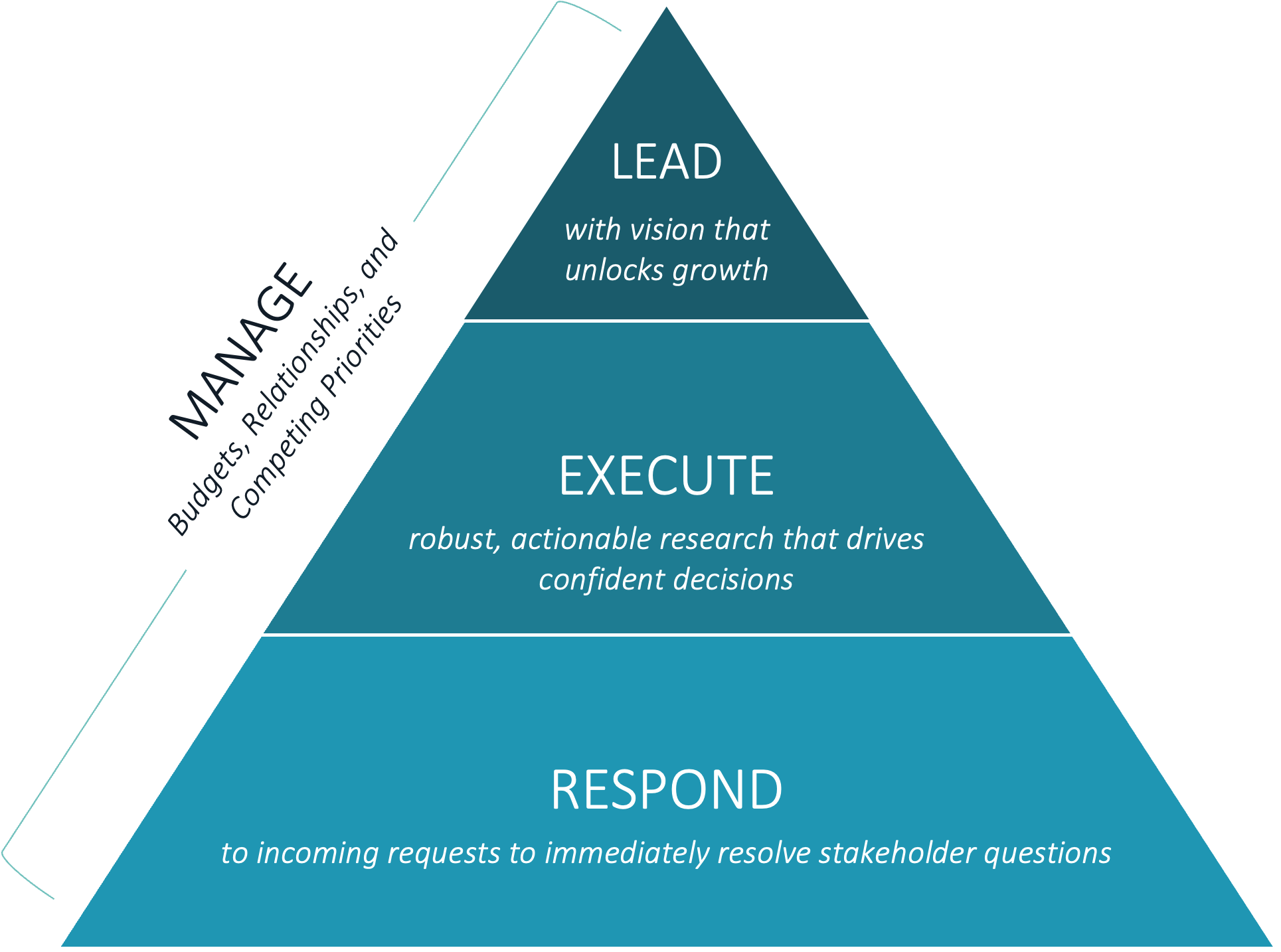

That understanding became the foundation of what we call The Four Modes of Consumer Insights Work.

This model guides everything we do at Langston. Our understanding of how the Consumer Insights role is structured informs how we design partnerships, build research offerings, and structure engagements. Increasingly, it also shapes how we think about technology, including how software and AI can meaningfully support insights work without undermining rigor or trust.

A Role Defined by Questions, Not Deliverables

Consumer Insights work revolves around questions.

Some arrive urgently from sales or marketing teams. Others emerge slowly from strategic uncertainty. Some are about clarifying what’s already known. Others challenge how the organization understands its consumer entirely.

What varies is not the importance of these questions, but the context in which they are asked.

In practice, insights leaders may find themselves:

Pulling together context from past research to resolve a last-minute stakeholder question

Designing and overseeing new studies to address a strategic unknown

Helping senior leaders rethink how they understand consumers and growth

Balancing timelines, budgets, and expectations across teams

These aren’t separate jobs. They are different modes of the same role. And each mode requires different kinds of support.

The Four Modes of Consumer Insights Work

This model organizes Consumer Insights work into four modes:

Respond

Execute

Lead

Manage

These aren’t titles or hierarchy levels. They are modes of work that insights leaders move between fluidly, often within the same day.

Respond: Resolving Immediate Questions With Confidence

Respond work often dominates the day-to-day reality of insights teams.

This is where insights leaders field incoming requests and assemble what’s already known. They do this by drawing from prior studies, third-party data and partners, and institutional knowledge.

Questions in this mode often sound like:

“Marketing wants to build a new messaging approach. Do we have any data to support this?”

“Something in this study doesn’t quite add up. How should we interpret it?”

“Can we pull a few slides for a retailer meeting next week to support a shelf-space conversation?”

The work here isn’t simple retrieval. It’s aggregation, interpretation, and communication. It involves understanding the underlying need, identifying relevant sources, and packaging information so others can quickly understand it and trust it.

Execute: Creating Net-New Understanding

Execute is the mode most often associated with formal research.

It includes:

Designing, fielding, and monitoring new research efforts

Ensuring studies deliver genuinely new, relevant insight

Planning share-outs and follow-ups so findings are used, not forgotten

Questions in this mode often include:

“Is this the right methodological approach to drive action?”

“How can we design this to build on what we already know?”

“What’s the most effective way to share this now that we’re out of field?”

This is the mode where insights leaders most traditionally work with a partner like Langston. But strong partnership matters across every mode. Most insights leaders don’t actually spend the majority of their time in Execute, which is why we approach research design with success in the other modes in mind.

Lead: Shaping How the Organization Understands the Consumer

Lead is the most transformational mode of Consumer Insights work.

This is where insights leaders challenge stakeholders to focus on what truly drives behavior and choice, push the organization to evolve how it listens to consumers, and embed consumer understanding into strategic decisions.

Questions in this mode reflect a different headspace:

“Do we really understand our shopper through the most meaningful lenses?”

“How can we elevate consumer understanding across the organization?”

“What differentiators truly matter, and how should they show up in our strategy?”

Lead work is less about answering individual questions and more about shaping how questions are asked in the first place.

Manage: Balancing Constraints While Keeping Work Moving

Manage work happens continuously alongside everything else.

It includes navigating the ongoing tension between time, cost, and quality; setting and managing stakeholder expectations; and prioritizing work in the face of limited resources. It can also include more strategic efforts, such as structuring the rollout of new insights in ways that “merge with traffic” across the organization.

While often invisible, this mode of work is essential to sustaining trust and momentum over time.

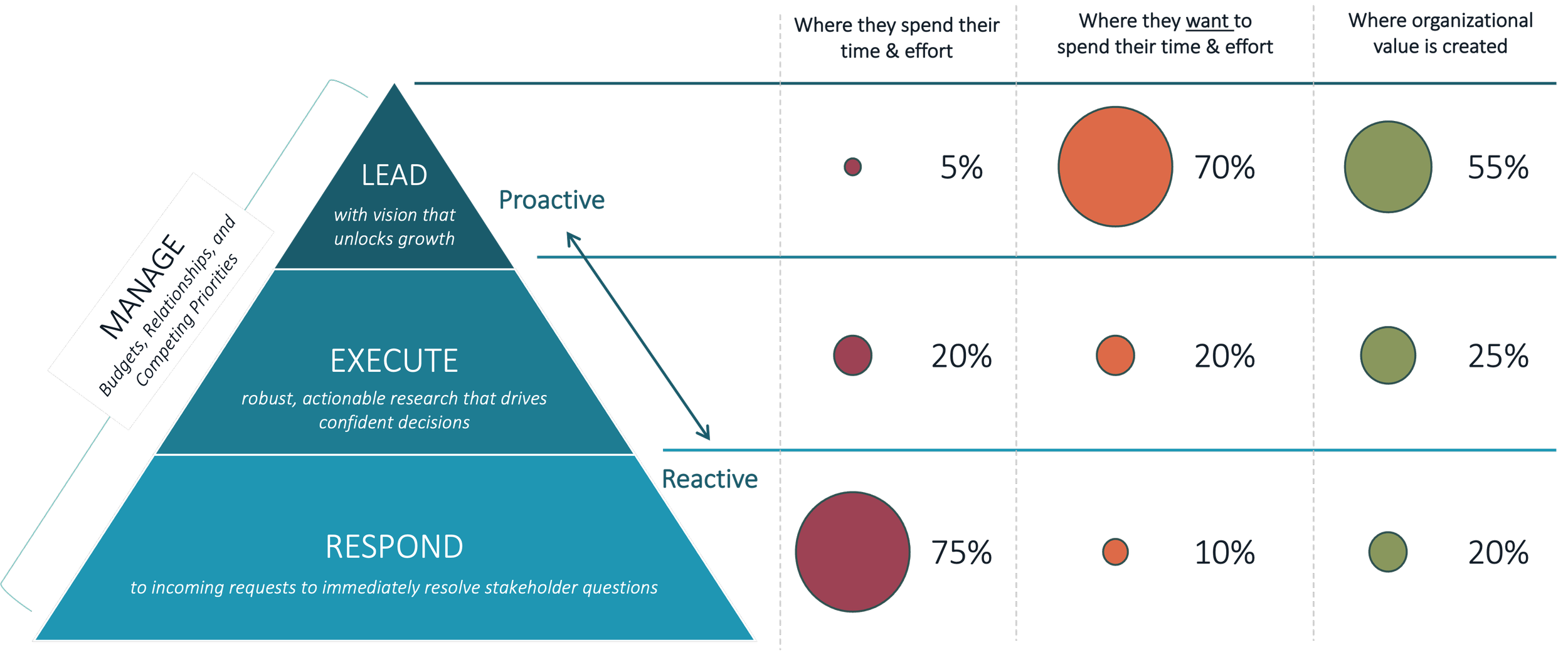

The Tension at the Heart of the Role

When we look at how Consumer Insights leaders actually spend their time, a familiar pattern emerges.

In many organizations, it’s common for roughly:

75% of time to be spent in Respond

20% in Execute

5% in Lead

This isn’t a failure. It reflects how often insights teams are relied upon to provide clarity in the moment. But when we ask insights leaders how they want to spend their time, the picture changes.

In an aspirational version of the role, the allocation is nearly inverted:

20% in Respond

25% in Execute

55% in Lead

This shift isn’t about avoiding tactical work. It’s about maximizing impact. Most insights leaders enter the field because they’re fascinated by human behavior and motivated to shape how brands serve consumers. That impact is felt most strongly in Lead.

Designing With the Consumer Insights Hero in Mind

We use The Four Modes of Consumer Insights Work as a grounding lens to understand how our clients experience their roles, including where friction tends to emerge.

The Consumer Insights Hero is our shorthand for the people we partner with, whether that’s a Director of Consumer Insights or a CMO working to ground strategy in consumer understanding. Regardless of title, they:

Act as an information hub for consumer and market knowledge,

Connect marketing, product, sales, and leadership to the consumer, and

Balance original research, third-party data, and constant stakeholder needs.

It’s a demanding role that requires clarity, confidence, and trust.

By anchoring our thinking in these four modes, Langston is able to meet Insights Heroes where they are and support them across every part of their work. That grounding informs how we build research offerings, train and coach our team, and design technology and processes that make the role easier and more effective.

The Outcome: Confidence That Scales Across the Role

This model isn’t about prescribing how insights leaders should work. It’s about acknowledging the reality of the role and designing support that makes it easier to move toward higher-impact work over time.

When all four modes are supported effectively, insights leaders can:

Respond quickly and credibly,

Execute research that holds up,

Lead with clarity and conviction, and

Manage constraints without compromising standards.

That confidence, grounded in clarity and trust in the data, is what allows Consumer Insights to truly influence organizations. It’s the outcome we’re committed to supporting through our partnerships, our research, and the technology we build for the future.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.