Win the Top Quartile to Win the Category: How to Attract High-Spending Consumers

Blog Post

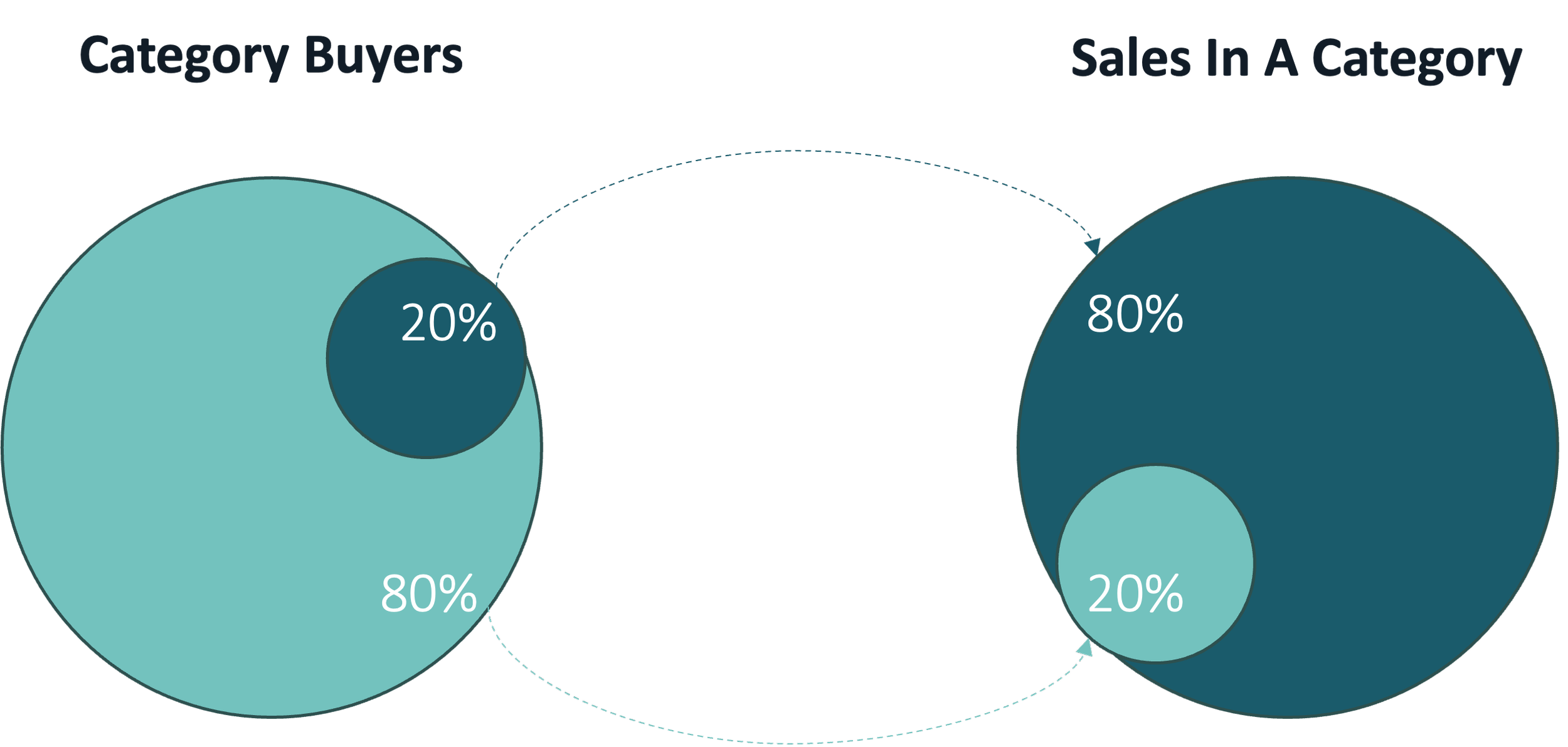

Since Langston was founded, we’ve surveyed literally millions of consumers across hundreds of consumer categories. And while a lot of themes show up repeatedly in the data, there’s one pattern that consistently determines which brands thrive and which ones struggle. It's a pattern that is equal parts simple, intuitive, overlooked, and impactful.

Most brands build strategies to win with this audience. This losing strategy prioritizes total reach and efficient CAC. The result is often worse performance in the long-run, plus a brand that follows trends instead of leading them.

The pattern: across category after category, a small group of consumers is responsible for outsized spend in that category.

Makeup

21% of Makeup Buyers contribute to 61% of spend

Liquor

20% of Liquor Buyers contribute to 70% of spend

International Travel

25% of Travelers contribute to 69% of spend

Scented Candles

23% of Candle Buyers contribute to 67% of spend

Brands that win with the much smaller group of shoppers that have higher category spend earn more revenue, benefit from higher customer LTV, and establish themselves as category leaders.

Sneakers for Everyday Wear

23% of Sneaker Wearers contribute to 67% of spend

Bicycles

22% of Sneaker Wearers contribute to 72% of spend

Writing Instruments

25% of Writers contribute to 70% of spend

Event Tickets (e.g., Festivals, Concerts)

23% of Event Goers contribute to 70% of spend

Take a minute to think about everyone you know. You’ll quickly realize there are “sneaker people” and “travel people” and “candle people” and “concert people” in your life. Once you start noticing these top quartile spenders in your own life, the next question becomes:

What sets them apart? What’s going on psychologically, emotionally, or behaviorally that makes them spend so much more in any particular consumer category?

5 Personality Trait Predictors Of Top Quartile Buyers

Across hundreds of thousands of data points from Langston’s studies featuring category participation and spend, we find a remarkably consistent set of traits that predict who shows up in the top quartile of spenders, regardless of category. These are:

Open-Minded: Top quartile spenders are curious, “yes people”, and drawn to experiences that stretch them.

Creative: Sometimes in the artistic sense, but always in how they think. Top quartile spenders connect ideas and imagine alternative ways of the world working.

Driven: Top quartile spenders are ambitious and want to achieve success in all facets of life.

Stylish: They care about fashion, aesthetic, and how they show up in the world.

ADHD: Many top quartile spenders are on the ADHD spectrum. This is something we will unpack more fully in a future article - there is a lot to say about it.

Two More Predictors: Income and the Category Wildcard

Income: Across our data, higher income consumers are far more likely to be top quartile spenders than lower income consumers. That should come as no surprise. Nonetheless, among higher-income consumers, these five traits are still the strongest predictors of who becomes a top quartile spender and who doesn’t. Personality shapes the behavior; income enables it.

Category Wildcard: We also almost always find a category-specific “wildcard” factor that meaningfully predicts whether someone is a top quartile spender. This “wildcard” is often demographic or psychological. For example:

In baby care, being 28–38 is a strong predictor of being a top spender.

In genealogy, being past-oriented drives deeper engagement with the category (and therefore spend).

In mountaineering gear, living in the Mountain West strongly increases spend.

These may seem obvious, but they are worth calling out, as each category tends to have one of these variables that reliably predicts whether someone is a top quartile spender.

Why This All Matters for Your Brand

Once you understand who the top quartile consumers are in your category, the implications for your brand become hard to ignore. Most companies still build for the broad middle, which allows them to optimize for reach, cost efficiency, and “average” consumers. That approach keeps the lights on, but it rarely creates breakout performance because average consumers don’t contribute to most of the sales, top quartile spenders do.

Focusing on the consumers who actually drive category economics has a very different effect:

1. Your business becomes meaningfully more profitable.

Top quartile spenders buy more often and buy more per transaction. When you orient around them, your LTV curves improve, your payback windows shrink, and your margins get healthier.

2. You stop reacting to the category and start shaping it.

Top quartile spenders are usually the early adopters and the “energy sources” of the category. Their preferences ripple outward. When you listen to them closely, you see what’s coming before everyone else does.

3. Your brand builds cultural gravity.

Retail partners take you more seriously. Collaborations come more easily. You show up more naturally in conversations, not because you forced your way in, but because your most passionate consumers pulled you there. When top quartile buyers love you, the rest of the category eventually notices.

This pattern is incredibly consistent across markets.

So What Should Brands Do With This Insight?

Understanding these consumers is not something that happens by accident. You can’t reach them through broad demographic targeting (“Millennials who travel”) or generic segments (“beauty enthusiasts”). Here are some tips on how to do that:

1. Use Quant to Understand What Truly Drives Them

Start with quant that gets specific to your category:

What needs they prioritize

How they use products

What motivates their decisions

How their attitudes differ from lighter buyers

Which behaviors actually predict spend

Quant should give you a clear, data-backed view of what makes top-quartile buyers unique. This is exactly why we at Langston built Landscapes the way we did: as a fusion of Segmentation, A&U, and Brand Health Tracking. Because Landscapes includes spend data, we can identify top quartile buyers within each category and measure all of these drivers in one integrated system.

2. Use Qual to Understand Why

Quant reveals patterns; qual illuminates human-centered stories.

Spend real time with these consumers:

Observe their homes and routines

Understand the role the category plays in their life

Explore their identity, emotions, and psychology by simply talking to them

This is where deeper drivers - aspirations, frustrations, rituals - come into focus.

3. Identify Them in Your CRM

Once you know who they are, find them inside your own customer base:

Tag top quartile profiles based on how much they’ve spent with you

Compare their behavior to the rest of your users

Look for consistent patterns in acquisition, retention, and loyalty

CRM then becomes a source of ongoing insight, not just a marketing tool.

4. Embed Them Into Your Organization

Make these consumers part of how your company thinks and works:

Give them names, personas, and muses

Create simple profiles teams can reference

Share quotes, photos, and stories internally

Use them to anchor marketing, product, and brand decisions

Your teams should feel like they “know” these buyers, not just know about them.

Closing Thoughts

We’re energized by where this framework is taking us, and in 2026 we’ll be sharing much more on how brands can understand, engage, and grow with their top quartile spenders. If you’re interested in learning more about how you can win with top quartile buyers, drop us a note.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.