Healthy, Wealthy, and Stylish: Using Personality Traits to Identify Top Health and Wellness Spenders

Blog Post

Health and wellness is often framed as a universal pursuit, but spending in the category is anything but evenly distributed. While most Americans engage in some form of fitness, nutrition, or self-care, a relatively small group accounts for a disproportionate share of total spend.

Using data from a large-scale 2025 study, we examine how personality traits shape not just participation, but depth of engagement and willingness to spend, and what that means for brands looking to unlock meaningful growth in the category.

In 2025, Langston ran a large-scale study exploring a broad set of health and wellness behaviors, from fitness and supplements to mental health, recovery, and self-care.

Today, we want to connect that data back to a theme from our last newsletter: top quartile spenders. Specifically, we wanted to answer this question:

“Do the same personality characteristics that drive outsized spend in consumer categories also predict spending in health and wellness?”

Spoiler alert: They do. (Why else would we write this whole thing?!) But before getting into psychology or spend concentration, let’s zoom out and ask another foundational question that a health and wellness-focused researcher might ask:

“What health and wellness behaviors are Americans actually engaging in today and how much do they spend when they do it?”

As you can see, lots of health and wellness behaviors don’t require too much spend, and those that do are often specialized like massages and physical therapy or groceries and passion projects. So if you want to target high spenders in the health and wellness space, you can either start a PT clinic/bodega service (tough sell to the boss) or you can efficiently unlock the high spenders already in your category.

Good news - the second option is completely within your reach.

Do the same universal spend drivers still apply?

We’ve previously talked about five personality traits that consistently predict top quartile spenders across consumer categories:

Ambitious

Stylish

Creative

Adventurous

ADHD

And so we return to our central question:

“Do the same personality characteristics that drive outsized spend in consumer categories also predict spending in health and wellness?”

The answer is a very clear yes.

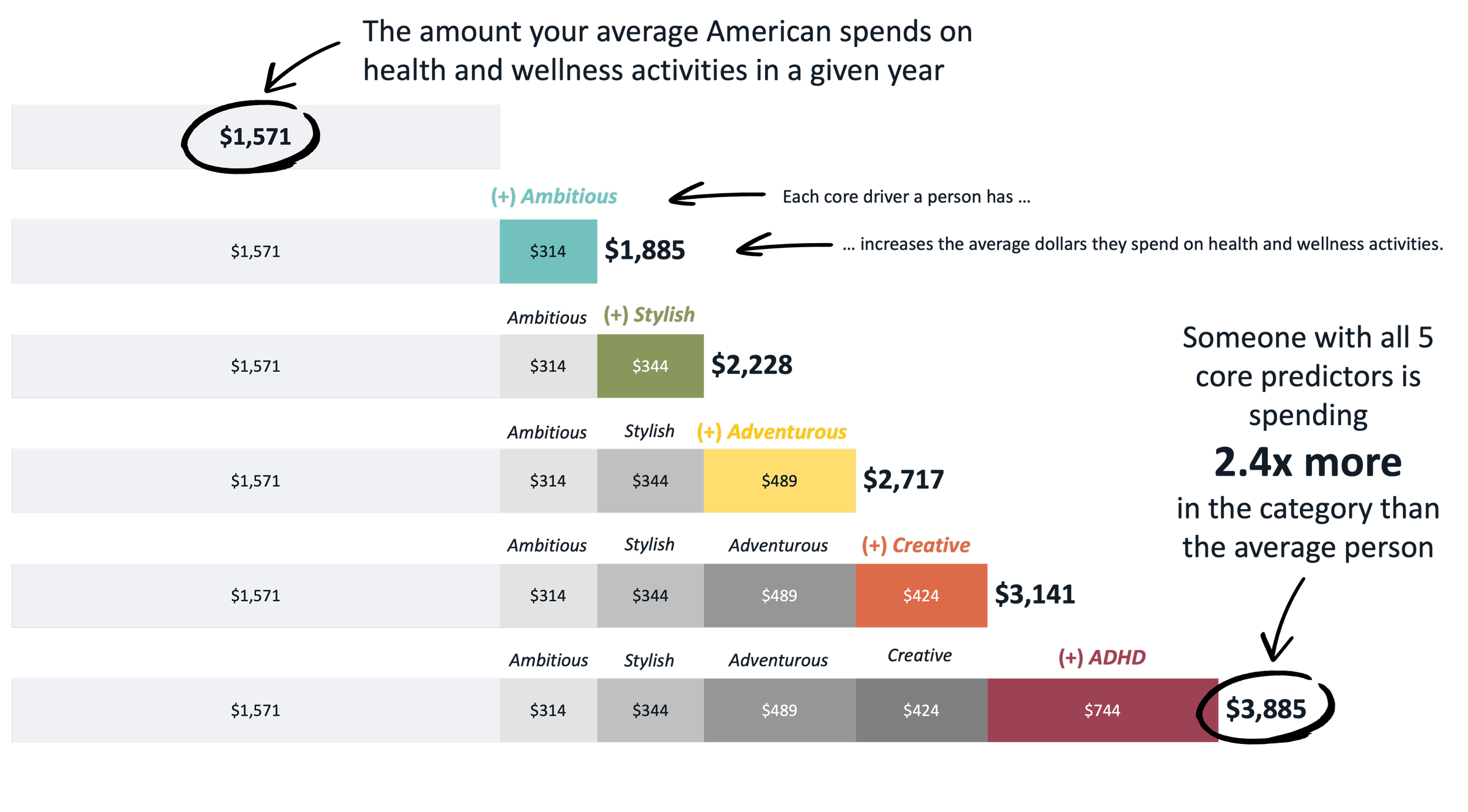

As you can see in the chart below, the same psychological stacking effect we saw across categories shows up again at the behavior level.

Across all measured health and wellness behaviors, the average American spends $1,571 per year. As we “stack” these characteristics within the same shopper profile, our shoppers’ spend increases. A person with all five will spend nearly two and a half times more than the average shopper.

You might be asking - “Isn’t this just age and income?” After all, younger consumers or higher income consumers might be more likely to say they are stylish, or ambitious, or have access to information and doctors to diagnose neurodiversity.

That's a reasonable question. Health and wellness spend is heavily influenced by both age and income, and these traits might simply be proxies for those variables.

But we find that they’re not.

When we control for age and income in our regression models, these personality-driven differences remain large and statistically meaningful. Income enables spend, but personality shapes where and how that money actually gets deployed.

What doesn’t predict wellness spend

Just as important is what fails to predict higher spend in health and wellness. Several traits that brands often assume are core drivers turn out not to be:

Outdoorsy

Family-oriented

Curious

People-pleasing

These traits may influence participation, but they don’t reliably predict who becomes a high spender on health and wellness behaviors.

The wellness “wildcard” drivers

As with other categories, health and wellness has its own “wildcard” predictors. Two stand out consistently:

Self-nurturing individuals

Progressive individuals

These factors meaningfully amplify spend beyond the core personality stack and help explain why certain consumers go much deeper (and spend much more) than others. They’re not universal to all categories, but they pack a punch in the health and wellness space.

Table stakes drivers

Finally, all categories have their table stakes drivers of spend. Wouldn’t you know it - the strongest personality trait that drove increased spend in the health and wellness category was… health-consciousness.

We didn’t showcase this above because the assumption is that you’re already considering a category-engaged person in your targeting decisions. But it is a good reminder that, while it’s important to leverage these smaller differentiators to target the most lucrative audience, you can’t take your focus away from the obvious drivers, too.

Why this matters for health and wellness brands

Most wellness brands still design for the “average” consumer or make a play for scale by targeting the most common health and wellness behaviors. That might keep growth steady, but it also caps the upside.

The economics of the category, once again, are driven by a relatively small group of top-quartile spenders with very specific psychological profiles.

Understanding who they are and what truly motivates them might change how you think about product design, messaging, pricing, and growth strategy - and it might even feel like a bit of a stretch from your current brand identity - but connecting with top quartile spenders on an emotional level is proven to increase your ultimate return on investment.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.