How Early Fiber Adopters Preindicated Today’s Wellness Trends

Blog Post

Fiber has long been part of the nutrition conversation. What is new is the role it now plays. By 2024, a group of consumers had elevated fiber from a general health recommendation to an active, intentional part of their broader wellness routines. Importantly, this group mirrors the consumers who tend to drive health and wellness trends forward.

In this article, we examine our nationally representative study of 3,189 Americans ages 13 to 79, which we fielded in early 2024 as part of a broader look at health and wellness behaviors. That timing matters. Because the study predates the fiber “moment,” it allows us to look past hype and instead focus on what types of consumers were already increasing fiber intake, and what their behavior and preferences may signal about which health and wellness trends are next.

Examining Attitudes Around Fiber

Rather than looking at who talks about fiber now, this data helps us understand who was acting on it before it was fashionable to do so. We split respondents into two groups based on self-reported behavior at the time of the study. One group said they were actively trying to eat more fiber. The other did not report making any effort to increase fiber intake.

That simple distinction revealed meaningful differences. Not just in demographics, but in how people think about health, how they manage their bodies, and what other behaviors are associated with those trying to increase fiber intake.

Fiber Was the Signal Most Brands Missed

Some of the initial differences align with patterns we consistently see across our work. Consumers who were already increasing fiber intake skewed higher income and were more educated. 42 percent reported household incomes over $100K compared to 35 percent of the rest of the population, and 45 percent were college educated versus 36 percent.

Income and education function as enablers. They increase access to higher quality food, exposure to health information, and expectations around personal wellness. In many cases, they also shape social environments where health is discussed more openly and more often.

More importantly, fiber adoption does not appear to be an isolated dietary tweak. It shows up as part of a broader, more active approach to health. Fiber-conscious consumers were more likely to track their health using wearables, more likely to engage in regular physical activity, and more likely to list focusing on physical health and well-being as their top personal needs.

They were also more embedded in the ecosystems where health ideas circulate. Compared to others, they were more likely to lean on their social circles for health information. They were more likely to turn to social media for wellness trends, YouTube for guidance, and online product reviews when making health-related decisions.

These are environments where ideas spread quickly, normalize fast, and reinforce one another.

With Every Fiber of Their Being

If the people increasing fiber intake in early 2024 are early movers, the more interesting question is not just what they were doing, but what else they were doing at the same time.

Across more than 60 behaviors tested, fiber-conscious consumers were 65 percent more likely to participate in at least ten additional personal goals tied to diet, inflammation, and environmental health.

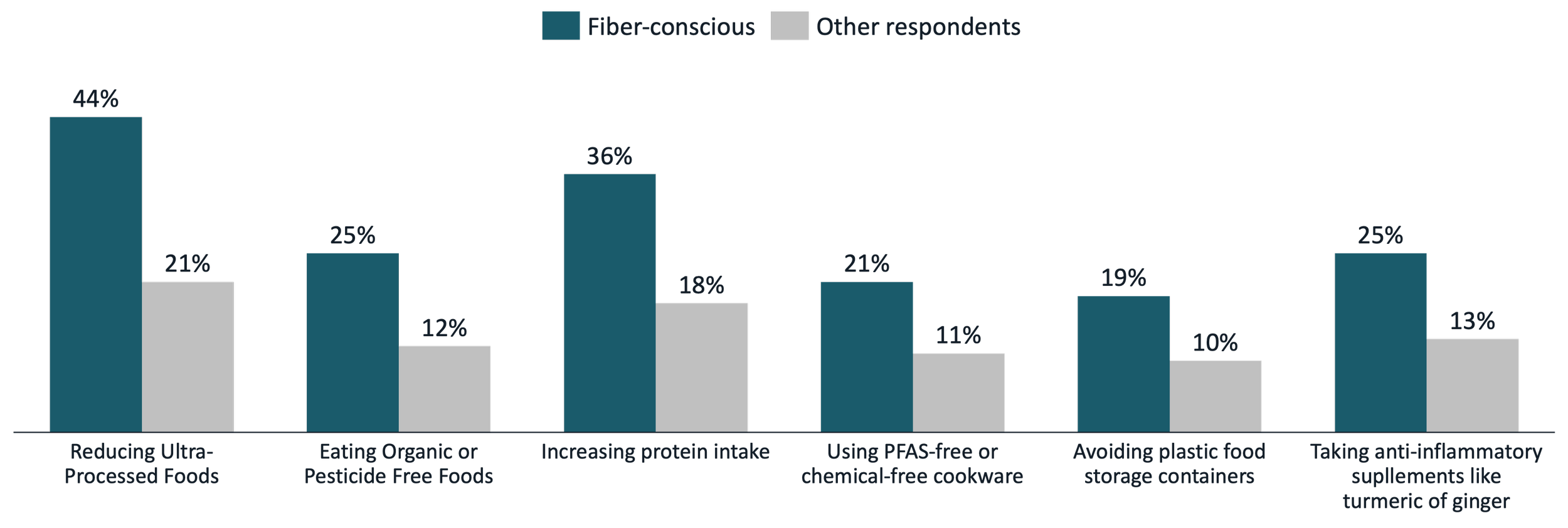

That includes reducing ultra-processed foods and added sugar, eating organic or pesticide-free foods, increasing protein intake, using PFAS-free or chemical-free cookware, avoiding plastic food storage containers, and taking anti-inflammatory supplements such as turmeric or ginger.

Taken together, these behaviors point to a broader philosophy. One centered on controlling what goes into the body, minimizing perceived sources of harm, and reducing inflammation. Fiber fits into this worldview, but it is not the headline. It is one expression of a more comprehensive approach to health management.

The Underlying Needs

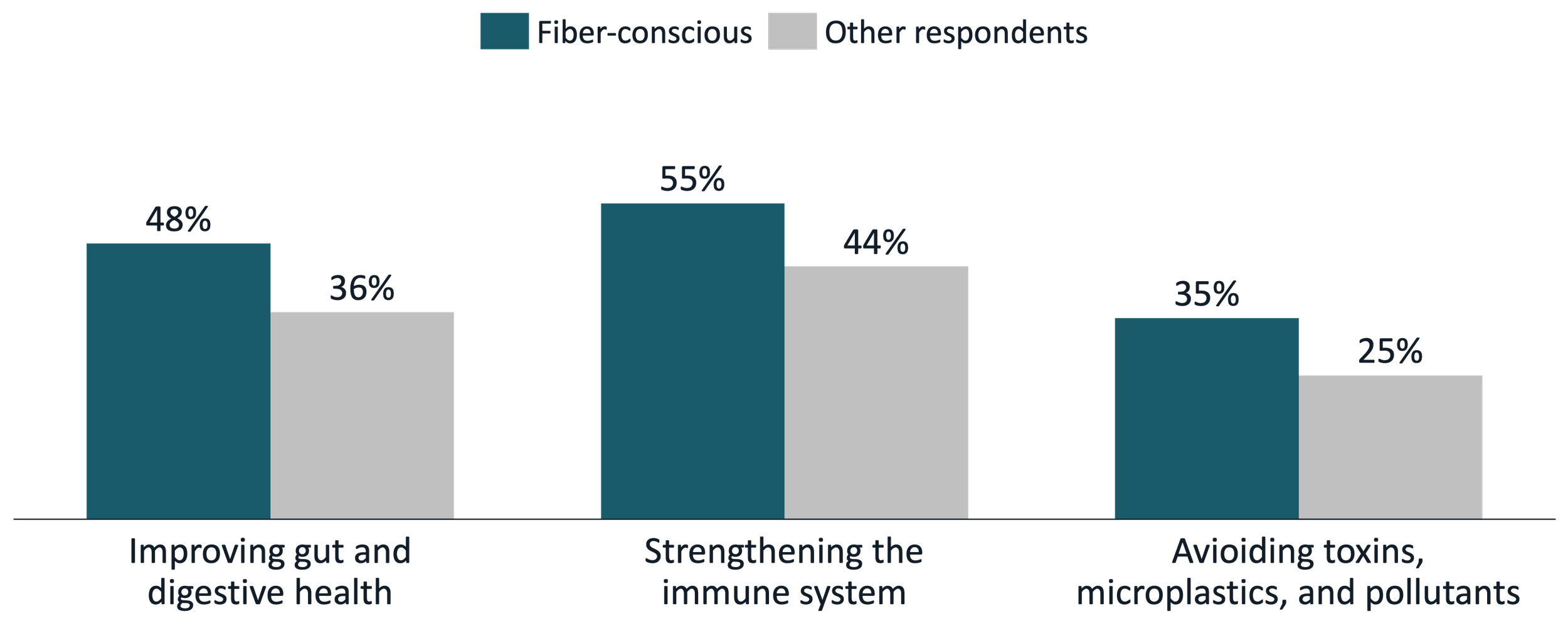

When we look at stated health needs, three stand out as having the largest gaps between fiber-conscious consumers and the rest of the population.

Nearly half of fiber-conscious consumers said improving gut and digestive health is a top need, compared to just over a third of others. A majority said strengthening the immune system is a priority. And a significantly higher share said avoiding toxins, microplastics, and pollutants is important to them.

These needs help explain why fiber matters to this group. Fiber is not just about digestion in isolation. It sits at the intersection of gut health, immunity, inflammation, and perceived protection from environmental harm.

What Comes After the “Fiber Moment”

If these fiber-conscious consumers are cultural early movers, the data points to two broader themes likely to shape future health behavior in the U.S.

The first is an increased emphasis on avoiding toxins and microplastics. That includes greater use of water filters, continued movement away from plastic toward glass or metal food containers, and growing demand for pesticide-free food products.

The second is a continued shift toward minimizing inflammation. That likely means further reductions in processed foods and alcohol, along with increased interest in clean-label and functional formulations, including supplements associated with inflammation management.

Fiber fits neatly within both themes, which helps explain why it gained traction so quickly once it entered the mainstream conversation.

The Lag Between Behavior and Brands

One final observation is less about fiber itself and more about how trends move from consumers to shelves.

Across food, wellness, and even fashion, we consistently see a lag between when consumers begin changing behavior and when brands respond at scale. Consumers adopt quietly. Brands wait for confirmation that a shift is durable rather than fleeting. Then, once they commit, it takes time to update messaging, packaging, and eventually product formulation.

Given that fiber-conscious behavior was already present in early 2024, we would expect grocery shelves to begin reflecting more fiber-forward messaging gradually, starting in spring 2026 and beyond.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.