Unbottling the Secrets of Beverage Consumers: Uncovering White Space Opportunities for Energy Drinks

Case Study

Published July 2025

Insights from Langston’s canned and bottled beverage space study.

Overview

The following consumer insights case study in the canned and bottled beverage space, featuring Red Bull, has been produced solely for illustrative purposes by The Langston Co. The study was not commissioned by Red Bull, and Red Bull had no involvement or input in the development or execution of this research.

The writing is on the wall that standard energy drinks face major category headwinds, putting beverage manufacturers in a precarious position. The following study outlines how beverage manufacturers can diversify their portfolio of product offerings and focus on high value segments.

Americans spend more than $215b per year on canned + bottled beverages; just $3.7b of that is on Standard Energy Drinks.

Among 63 beverage types, Standard Energy Drinks rank poorly on the metrics that matter most to consumers (healthy, inexpensive, and delicious).

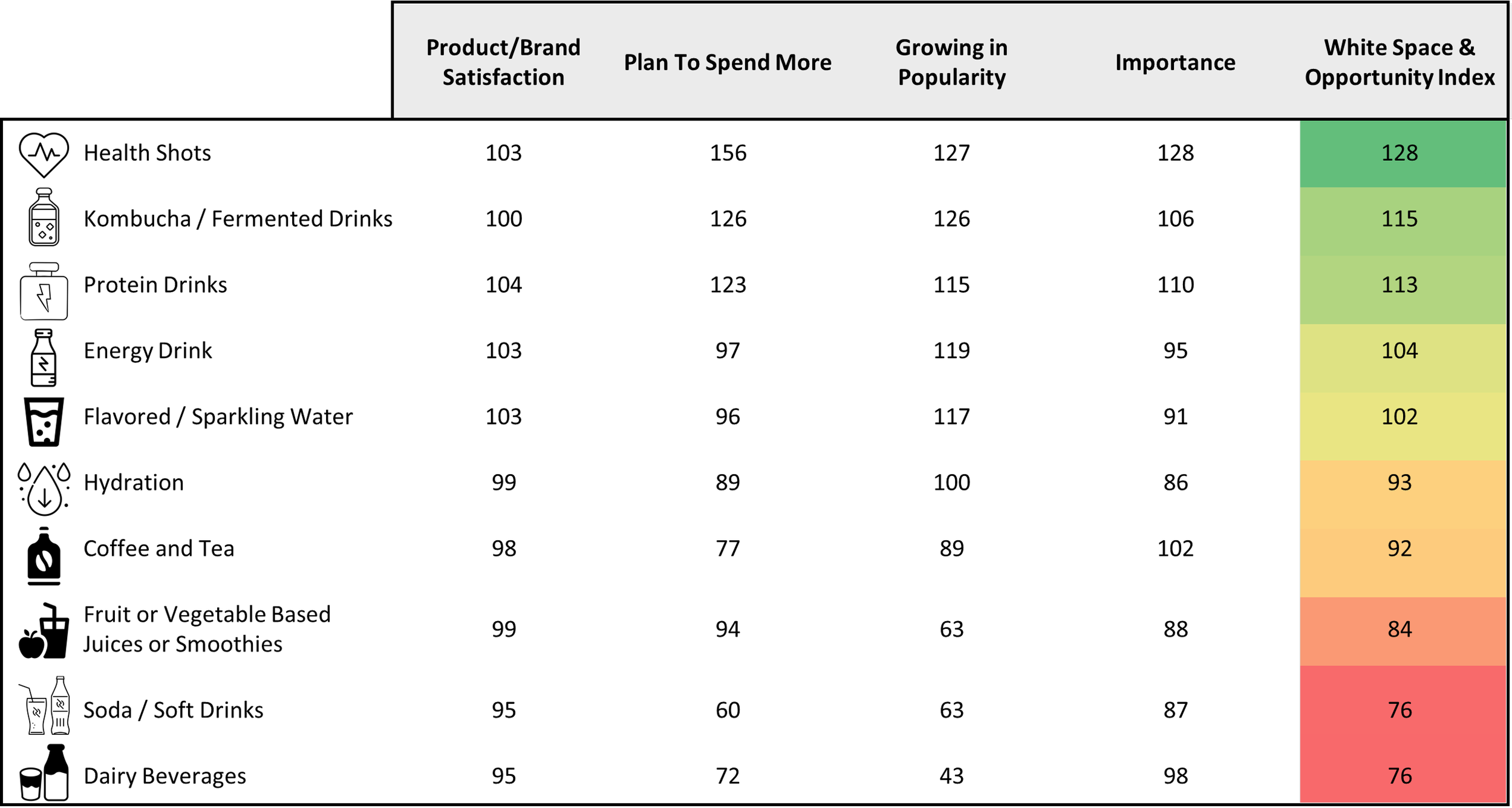

Some categories are on a steep ascent: Health Shots, Kombucha/Fermented Drinks, & Protein Drinks show the most promise for future growth.

Insights

Insight 1: Health Shots Lead the Beverage Innovation Landscape

Health shots, followed by fermented drinks and protein drinks, have emerged as the most promising category in the White Space Index—ranking highest across metrics like future spending intent, popularity, and perceived importance. Consumers are not only satisfied with these products, but they also see them as essential to their lifestyles. The demand spans across several sub-categories like energy-based, immunity-boosting, tranquility, gut-health, and anti-aging health shots, indicating that consumers are gravitating toward compact, functional wellness solutions.

White Space Index - Super Category Level

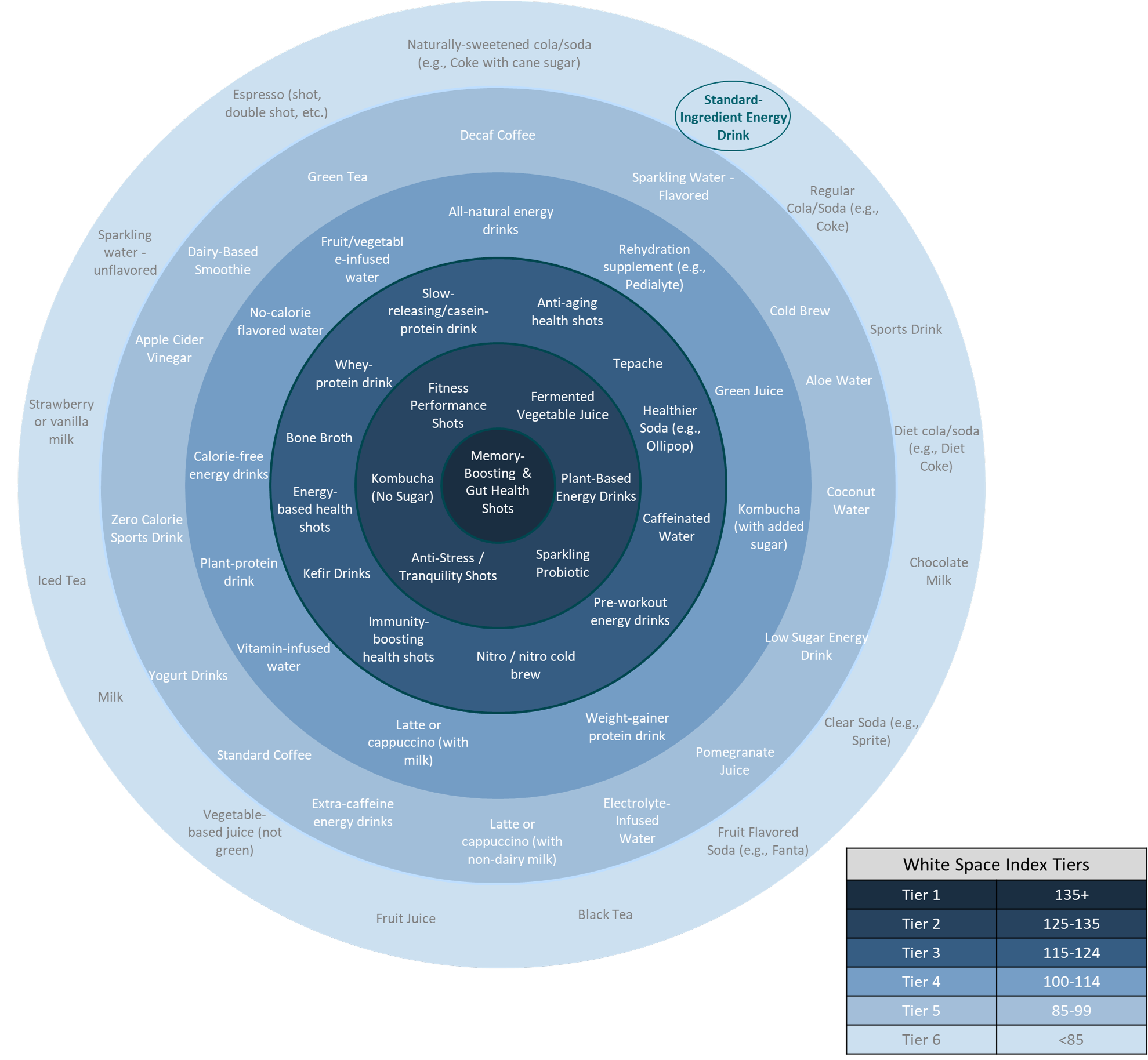

Insight 2: A Healthier Future for Energy — Plant-Based Alternatives to Standard Energy Drinks

While traditional energy drinks are facing mounting headwinds due to negative perceptions around health, sugar, naturalness, cost, and taste, the demand for energy hasn't disappeared…it has evolved. Plant-based and functional energy drinks, such as those featuring green tea, yerba mate, or guarana, are moving closer to the bulls-eye on the White Space Index. Consumers are shifting toward “clean” and “natural” energy sources, and they now favor beverages that align with their overall wellness goals.

White Space Index: Unfavorable Position of Standard Energy Drinks

Insight 3: Standard Energy Drinks Are Losing Favor

The study reveals that Standard Ingredient Energy Drinks rank among the lowest in perceived importance, future spend intent, and overall White Space potential. Only 12% of consumers intend to spend more on them in the future, while 19% plan to cut back, indicating a net negative growth trajectory. If major players in the category fail to adapt, they risk being outpaced by more functional and health-aligned competitors.

Perceptual Metrics: Relative Ranking of Standard Energy Drinks

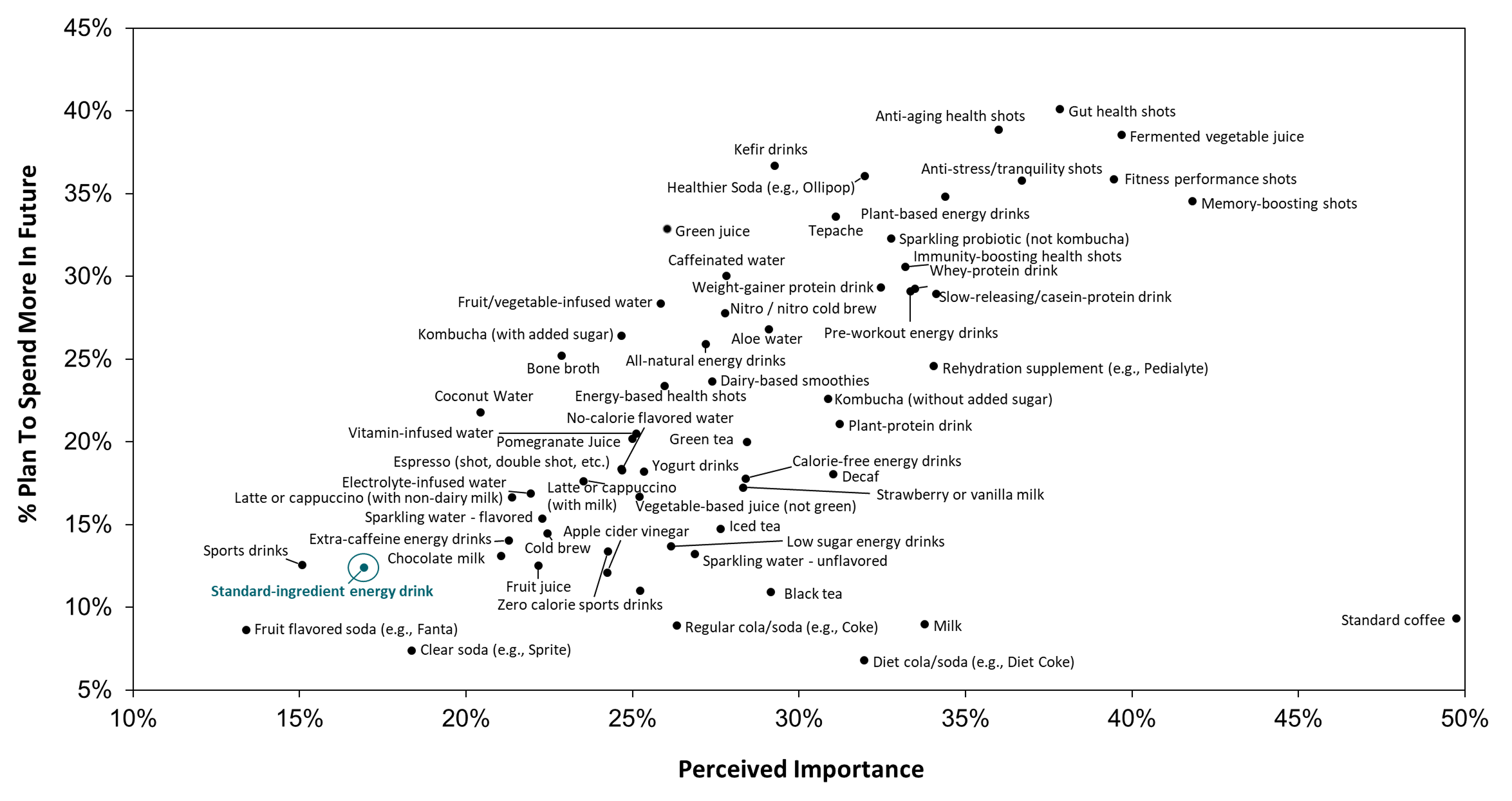

Insight 4: Emerging Functional Beverages Are Capturing the Consumer Imagination

Beyond energy drinks and health shots, categories like kombucha (especially sugar-free), sparkling probiotics, vitamin-infused waters, and protein-based drinks are gaining traction. These products score high on perceived importance and willingness to spend more, pointing to consumer appetite for beverages that not only refresh but also provide tangible health and performance benefits. The fastest-growing categories are those that blend function with flavor, giving consumers a reason to pay a premium while reinforcing their wellness routines.

Intentions To Spend More in Future & Perceived Importance

About the Study

The primary objective of this study was to deeply understand the landscape of canned and bottled beverage consumption by segmenting the market according to consumers’ attitudes, purchasing behavior, and overall approach to the category. It aimed to assess brand engagement levels for established and emerging players through the use of Funnel and Share of Wallet analytics. Additionally, the study quantified the size and dynamics of 63 beverage sub-categories, examining consumer perceptions and behaviors tied to each.

The study was conducted through a nationally representative survey of U.S. consumers aged 13 to 74 who had purchased canned or bottled beverages within the past 12 months. To uncover meaningful consumer segments, Langston applied a combination of Principal Component Analysis (PCA), K-Means clustering, and its proprietary “waterfall” segmentation framework. Share of Wallet and Category Sizing insights were derived from self-reported spending data, offering a comprehensive view of consumer investment across beverage types. All data collection and analysis took place in the second quarter of 2023, ensuring a current and relevant snapshot of the market.

Let’s Talk

This report highlights a focused set of insights from a much broader and data-rich exploration of the canned and bottled beverage landscape. It draws from Langston’s in-depth Beverage Study, which surveyed over 4,000 U.S. consumers to uncover category trends, consumer motivations, and brand opportunities. We absolutely love talking about this stuff. If you're curious to learn more about the study — or explore how Langston can help bring you closer to your consumers — we’d love to connect.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.

More insights, more data. Download this study to learn more.

In order to conduct unbiased and objective research, this study was privately funded by The Langston Co. We did not receive endorsement or financial support of any kind from any third party.

Thanks for taking time to read our research. With questions, comments, or suggestions about this study, please contact us at contact@thelangstonco.com.