Case Study

Big Spenders on Athletic Apparel: How to Win with the Influential Minority that Spends the Most

Published July 2025

Overview

Our athletic apparel study uncovers the outsized impact a small group of consumers has on the athletic apparel market. Drawing from a nationally representative study of over 5,000 respondents, it highlights how a minority of high-spending individuals is quietly shaping the future of the category, through what they buy, how they live, and what they expect from brands.

Explore behaviors, motivations, and cultural cues that distinguish these top spenders from the rest of the market. For brands seeking to grow with precision, the findings offer a compelling look at where influence truly lies. Download the full report to understand who these consumers are, and how to reach them.

What We Found

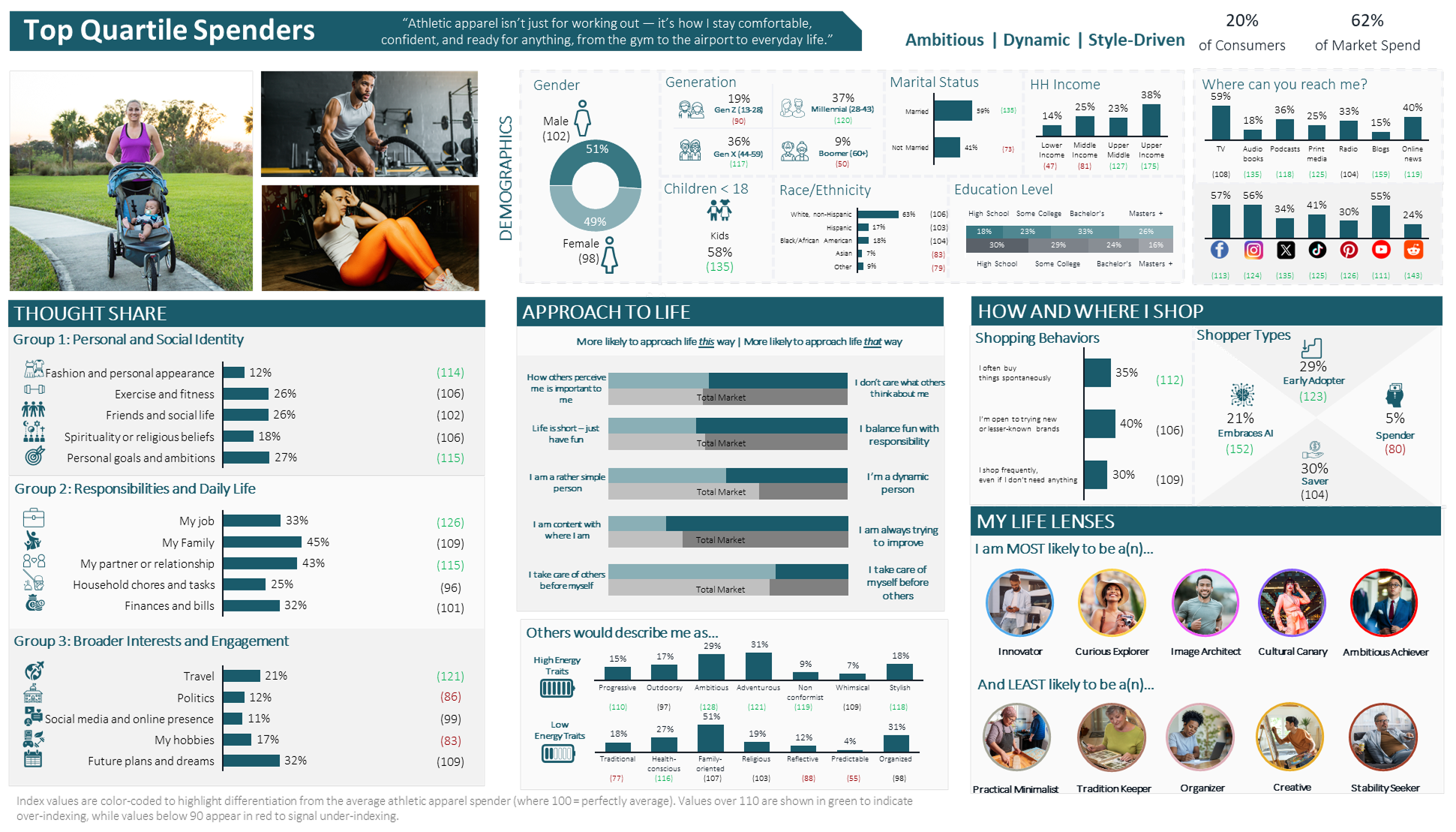

The Influential Minority Driving Athletic Apparel Sales

A small share of consumers is responsible for the majority of athletic apparel spending — and their influence extends far beyond the shopping cart. These individuals, who are young, high-earning, and dynamic, have made performance wear part of their everyday identity. For them, athletic apparel isn’t just for exercise — it’s what they wear to work, on flights, while parenting, and as a form of self-expression. They’re Ambitious Achievers who strive to improve, Curious Explorers who travel often, and Innovators who seek out what’s next. As Image Architects, they care about looking polished — and as Cultural Canaries, they shape trends others follow. Their preferences, rooted in a lifestyle that blends drive, style, and adaptability, are quietly redefining the category. The full study explores who they are and what drives them.

Top Quartile Spenders

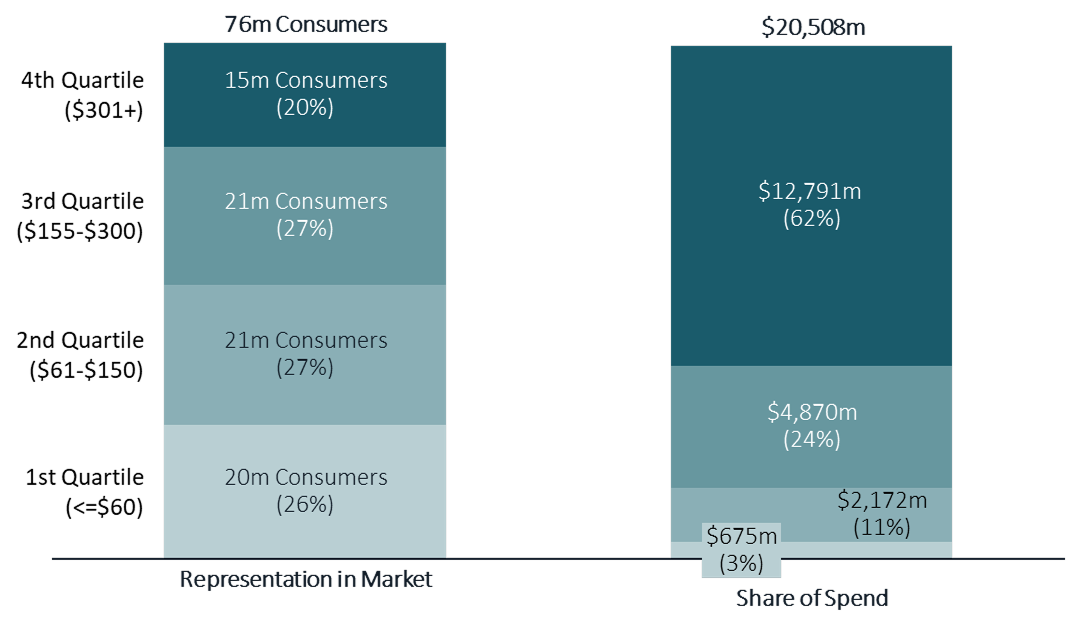

The Pareto Principle

This concentration of spend is a textbook example of the Pareto Principle—the idea that a small portion of inputs drives a large share of outcomes. Often simplified as the “80/20 rule,” its expression in the athletic apparel market is evident. However, this pattern exists across consumer categories explored by Langston. While some brands attempt to scale by appealing to the broader base, the most effective strategies are built around the influential few. By aligning products, messaging, and innovation with this core group, brands position themselves to capture disproportionate growth.

Market Share & Spend Share by Quartiles

About the Study

This study was conducted in January 2025 and included over 5,000 people across the U.S., ranging in age from 18 to 84. The group was carefully balanced to reflect the country’s diversity in age, gender, race, and income. Through a 15-minute survey, participants shared insights about their values, spending habits, media use, relationships, and more.

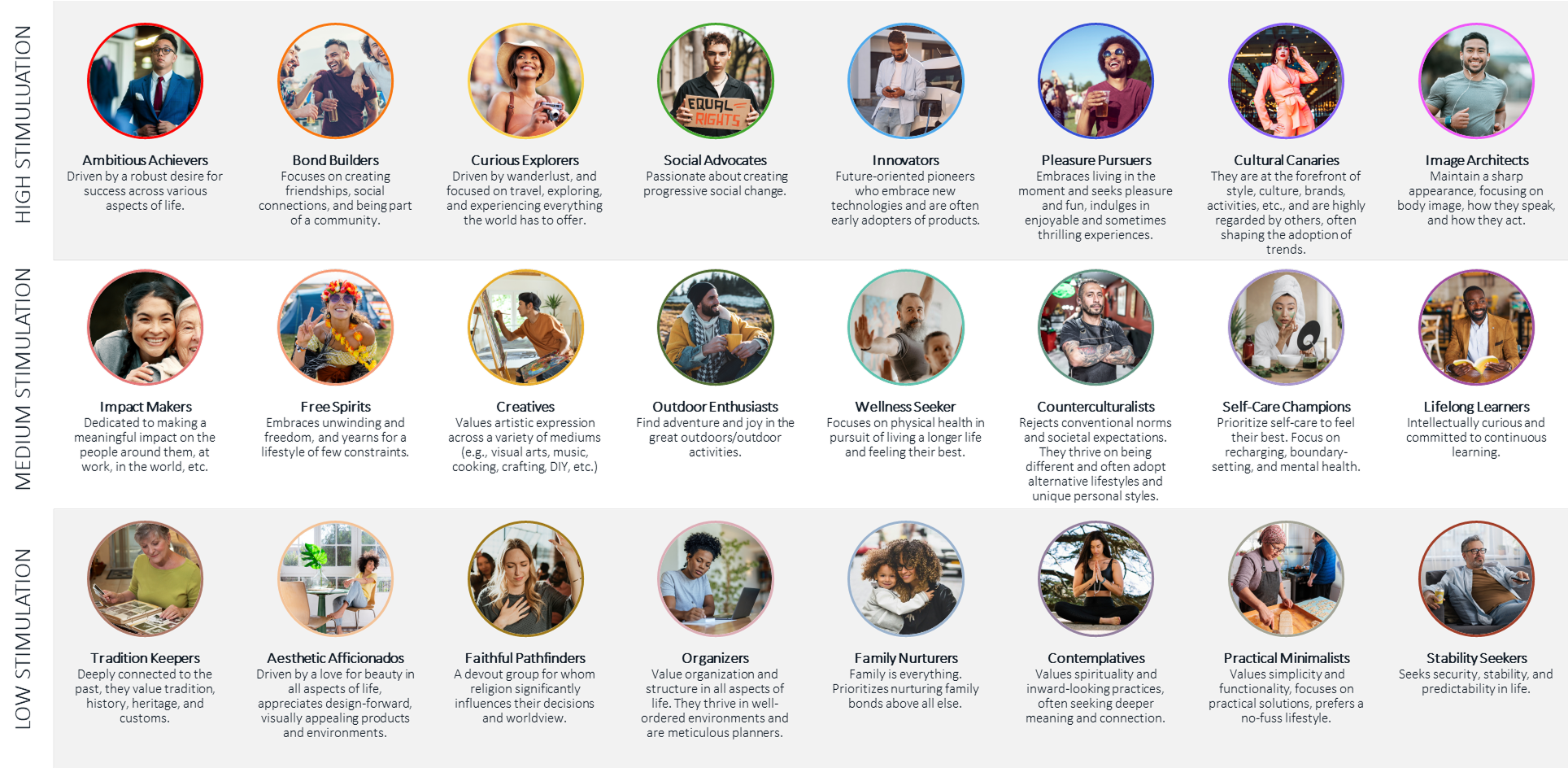

At the heart of the analysis is Life Lenses, Langston’s proprietary segmentation framework. With 24 distinct psychographic segments, Life Lenses helps brands and marketers understand not just what people do, but why they do it to help enable smarter, more resonant strategy.

You can learn more about the Life Lenses segmentation and download our free Meet the Segments report with detailed insights about each of the 24 types of consumers. The report includes information about how each segment is defined, what percentage of shoppers fall into each segment, and insights on how brands can reach and activate them.

24 Life Lenses shape how we navigate the world. They are:

Let’s Talk

This report highlights a focused set of insights from a much broader and data-rich exploration of consumer behavior in the US. It draws from Langston’s original research, which surveyed over 5,000 U.S. respondents aged 18-84. We absolutely love talking about this stuff. If you're curious to learn more about the study — or explore how Langston can help bring you closer to your consumers — we’d love to connect.

DISCLAIMER: We base our research, recommendations, and forecasts on techniques, information and sources we believe to be reliable. We cannot guarantee future accuracy and results. The Langston Co. will not be liable for any loss or damage caused by a reader's reliance on our research.

More insights, more data. Download this study to learn more.

In order to conduct unbiased and objective research, this study was privately funded by The Langston Co. We did not receive endorsement or financial support of any kind from any third party.

Thanks for taking time to read our research. With questions, comments, or suggestions about this study, please contact us at contact@thelangstonco.com.